U.S. Tariff Policy Unveiled: What It Means for the Economy

In a recent press briefing, the Trump administration declared its commitment to tackle long-standing issues with the U.S. trade deficit. The president's stance is clear: the nation's economic health is at risk, and substantial actions must be taken to ensure a robust manufacturing base. With a staggering trade deficit exceeding $1 trillion in 2024, government leaders stress the urgency in promptly addressing these challenges.

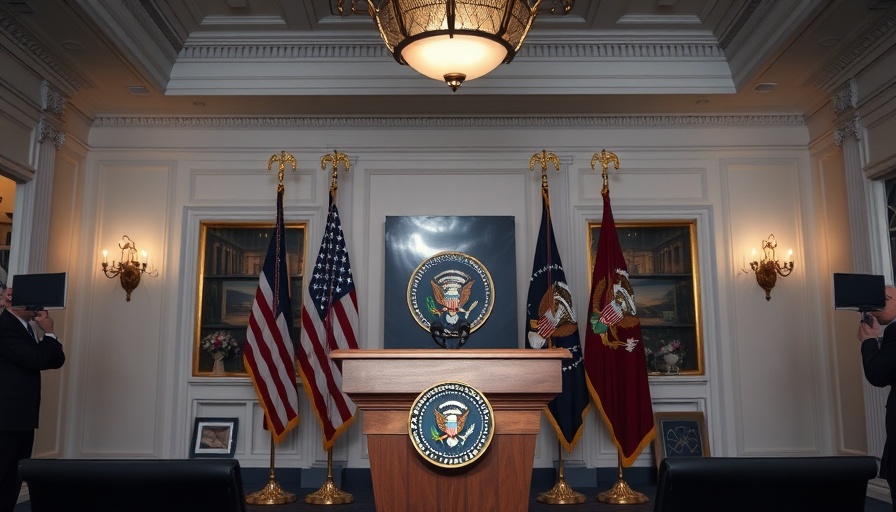

In 'White House Press Briefing | Thursday, May 29th, 2025', the discussion dives into U.S. tariff policies, exploring key insights that sparked deeper analysis on our end.

Understanding Tariffs and Trade Deficits

Tariffs function as taxes on imported goods, designed to protect domestic industries by making foreign products more expensive. As President Trump emphasized, the imposition of universal tariffs is a necessary step in correcting the imbalance that has led to the current trade deficit crisis. The president's efforts aim at rebuffing what he terms as judicial overreach, reiterating that his legal authority permits the administration to enforce these tariffs as a defense mechanism for national security and economic stability.

What the One Big Beautiful Bill Means for Average Americans

One significant piece of proposed legislation, dubbed the "One Big Beautiful Bill," is anticipated to revolutionize America’s economic landscape. The bill is touted to provide the largest border security investment ever made, alongside promising tax cuts aimed at boosting the middle class. However, it comes with a warning: if passed, it will sidestep a projected $4 trillion tax hike that would burden American families. Dubious claims from critics that the bill encourages deficit growth are deemed “shoddy” by members of the administration, who counter that its implementation will drive economic prosperity.

The Role of the Judicial System in Policy Making

During the press briefing, Trump administration officials voiced concerns over the increasing influence of unelected judges in shaping economic and trade policy. Judicial hurdles faced by the administration, particularly with tariff laws, prompt discussions on the need for judicial reform. Critics argue that these court interventions stifle not just Trump’s policy agenda but the longstanding principles of executive authority established within U.S. law.

Have Consumer Sentiments Shifted?

Despite turbulent legal ground and media criticism, consumer confidence in the U.S. economy is reportedly experiencing a revival. Recent statistics reveal that consumer sentiment surged in May, echoing broader optimism across various demographics. An administration's claim of "historic" momentum suggests that a significant majority of Americans now believe the country is on the right path – a sentiment that the White House attributes to President Trump's decisive actions.

Financial Strategies for Individuals Amidst Economic Policies

For budget-conscious families in the UK keeping a close eye on global developments, the implications of these U.S. policies are worthy of attention. Understanding tariffs can aid in strategic budgeting. As international prices for goods fluctuate due to tariffs, local families may experience shifts in pricing for products they frequently purchase, emphasizing the importance of adaptability in budgeting strategies.

Moreover, as the U.S. embarks on aggressive domestic economic policies, families are urged to reevaluate their financial strategies. Securing savings, exploring investment options, and remaining informed on economic trends will be crucial as these unprecedented approaches unfold.

Conclusion: Take Action for Financial Wellness

With critical policies like tariffs and major legislative efforts taking root, the economic landscape is shifting in ways that directly impact the daily lives of UK families. Monitoring these developments not only aids in navigating rising living costs but empowers them to make informed financial decisions. Stay proactive by assessing your family budget, exploring investment avenues, and adapting your savings strategies to safeguard your economic future.

Add Row

Add Row  Add

Add

Write A Comment