The Legacy of the 1944 White £5 Note: More Than Just Currency

In today’s rapidly evolving financial landscape, knowing the nuances of currency beyond its face value can empower us—especially for first-time buyers and young families embarking on the journey to home ownership. The 1944 White £5 note, while seemingly an artifact of history, serves as a fascinating case study introducing broader conversations about value, stability, and legacy in monetary systems.

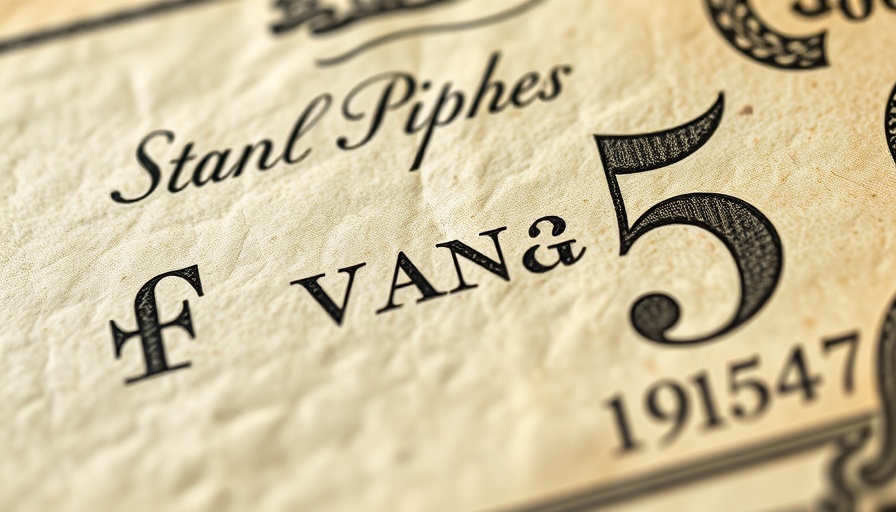

In '1944 White £5 note and more', the discussion dives into the historical context of currency, exploring insights that sparked a deeper analysis on our end.

Understanding Historical Contexts and Value

The 1944 White £5 note, issued during a tumultuous period of World War II, represented not only a means of transaction but also financial confidence in a recovering nation. For aspiring homeowners, the historical significance of such currency illustrates how economic factors—including inflation—impact our purchasing power and savings. Knowing the story behind money helps us understand the cycle of stability and risk, both crucial for making informed decisions during the mortgage process.

Emotional Connections to Currency

For many, money is not just numbers on a bank statement; it is tied to personal stories, milestones, and dreams. Consider how the 1944 note might be cherished as a family heirloom, sparking discussions about financial responsibility and aspirations. This emotional connection is critical for families planning their financial future. Understanding the heritage of our currency allows us to appreciate our current financial challenges, including rising property prices and inflation, and motivates us to seek smart financial advice.

Equipping Yourself for Financial Decisions

In light of rising costs, individuals preparing to enter the housing market can benefit from thoughtful engagement with financial history. As inflation impacts purchasing power, aspiring homeowners must also consider their mortgage strategies meticulously. Tools and techniques, from understanding interest rates to knowing local market conditions, enhance our ability to navigate property purchases wisely. Learning the significance behind various money forms, like the 1944 £5 note, can inspire homeowners to view their financial choices as parts of a larger story.

Future Insights: Navigating Inflation and Property Markets

With property prices on the rise, young families must adopt proactive financial behaviors and investment strategies. And just as the 1944 White £5 note has seen its value shift over time, so too will the housing market—affecting what homes are worth and what buyers can realistically afford. This cycle of inflation underscores the necessity of boosting savings, smart budgeting, and understanding mortgage implications—equipping aspiring homeowners to secure the best possible deals.

Actionable Insights for First-Time Buyers

As you step into the world of home ownership, consider practical steps: educate yourself about different mortgage products to find the right fit; build a solid savings plan; and stay informed about economic trends. Processing the lessons from the past, such as the value represented by the historic 1944 £5 note, can guide your decisions today.

As you embark on this journey, remember the value of community, mentorship, and open dialogue about financial choices—because securing your future doesn’t have to be a solitary endeavor; it’s a shared experience enriched by stories and lessons from those who walked before you.

Add Row

Add Row  Add

Add

Write A Comment